The Boise housing market is undergoing a significant transformation. In the throes of a 36% inventory shrinkage, the real estate landscape of Idaho’s capital city is being reshaped, offering both challenges and opportunities to potential homeowners and investors.

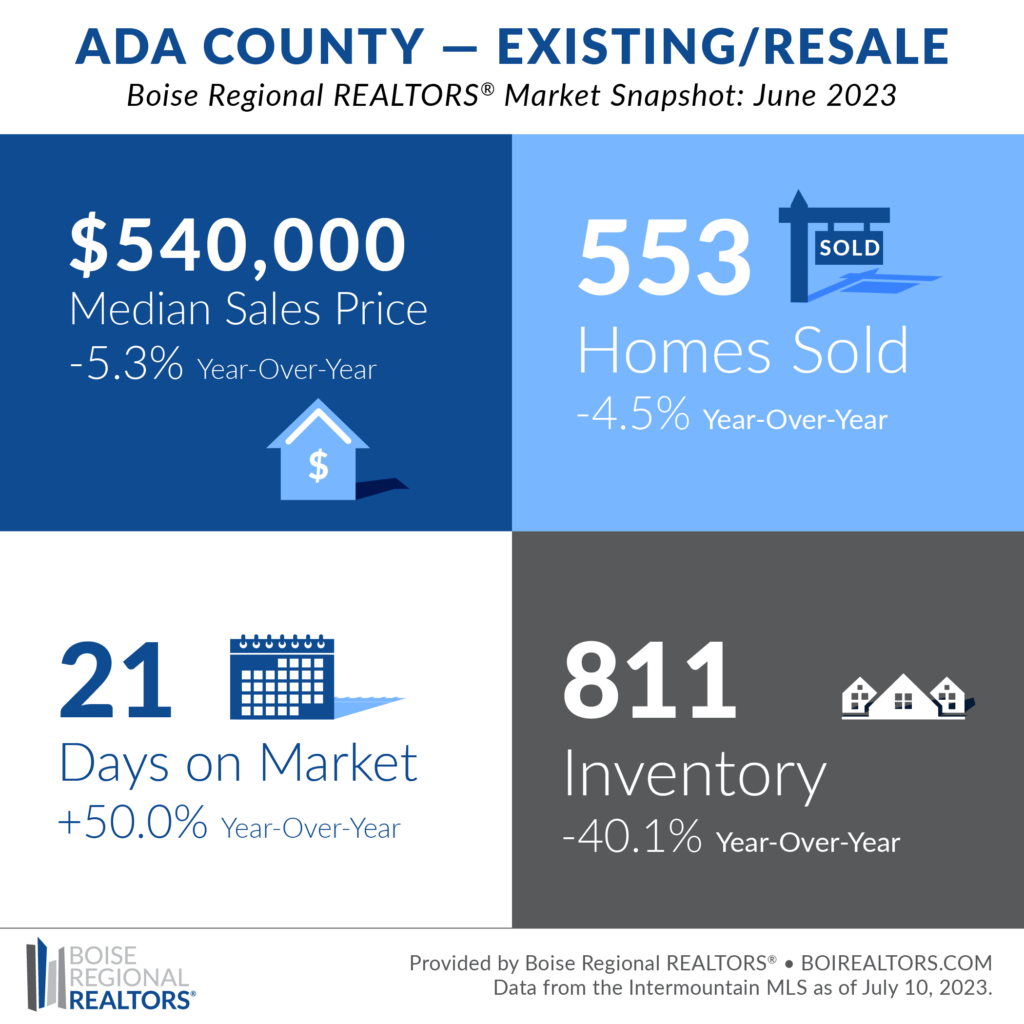

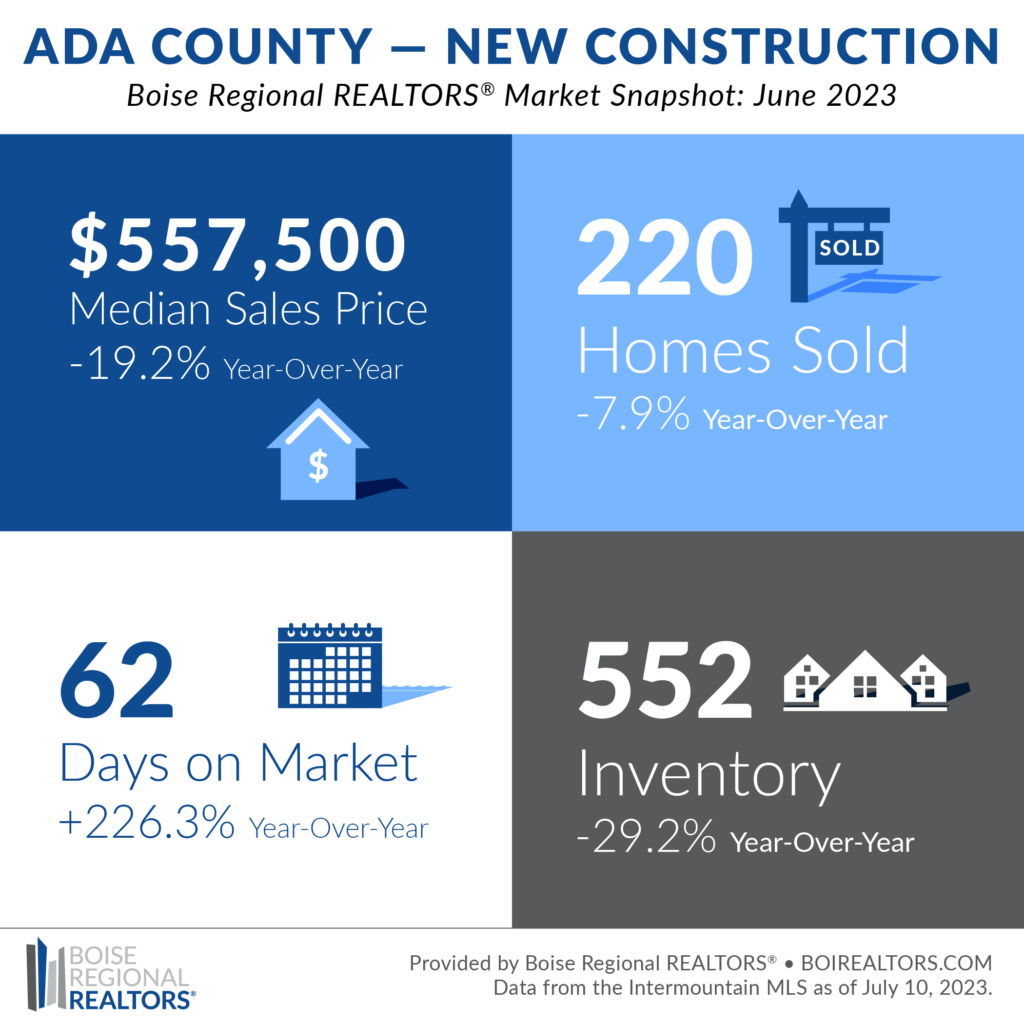

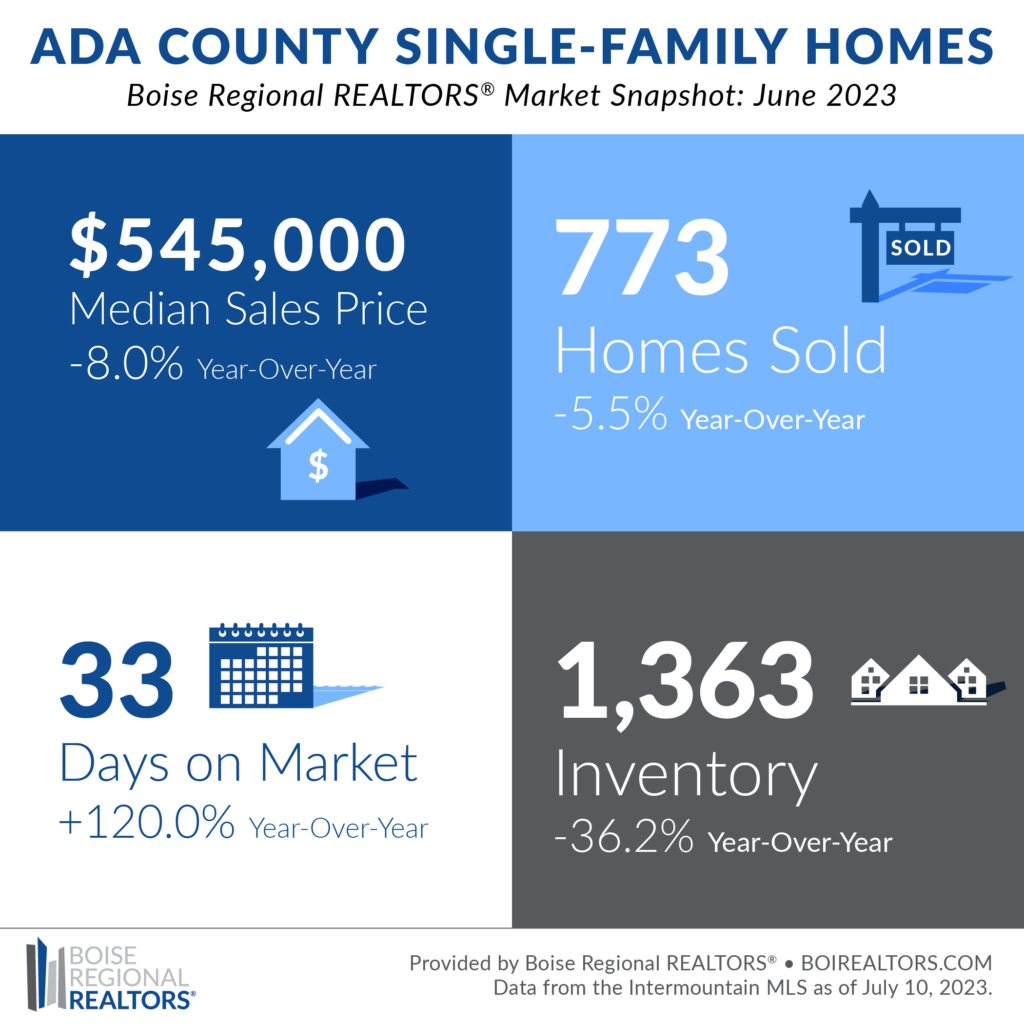

According to recent statistics, the median sales price in Ada County for June 2023 was $545,000, marking an 8.0% decrease from the same month a year ago. Despite this yearly dip, the price has seen a consecutive increase in the last three months. With the existing/resale sector maintaining a relatively steady pace at $540,000—an uptick of $30,000 from May 2023—there’s evidence of a slow but steady recovery. On the other hand, new construction witnessed a month-over-month drop of approximately $49,000, bringing the total median sales price down to $557,500.

As with many real estate markets, Boise’s is dictated by the age-old law of supply and demand. And currently, the scales of affordability are being tested by this dynamic. Pressures from increasing rent prices, especially for two-bedroom homes, are pushing consumers to look for alternatives to secure homeownership. Aided by tools like NAR & Apartment Therapy’s “Real [Estate] Talk” interactive hub and IHFA’s rental assistance programs, renters are finding innovative paths toward ownership.

The reason behind this push for ownership is clear. Beyond the relief from monthly rent checks and landlord negotiations, homeownership is a viable long-term investment. It is a pathway to wealth creation, with recent data from NAR revealing that middle-income homeowners could increase their wealth by over $120,000 in a ten-year span.

The Boise market, despite its current inventory challenges, is not stagnant. Mortgage applications have been on the rise for three consecutive weeks, indicating a forward motion. Yet, the reality remains that shrinking inventory could drive prices higher, even as mortgage rates currently at 6.81% offer a moment of reprieve from the three-month climb.

Navigating the intricate dynamics of the Boise housing market, especially amidst this period of transformation, can be complex. But, armed with the right information, both prospective homeowners and investors can make informed decisions that could potentially shape their financial futures. Stay tuned as we continue to explore and unravel the ongoing shifts in the Boise housing market.

ADA COUNTY HOUSING MARKET JUNE 2023

- Single-Family Homes:

- Closed Sales: There was a decrease of 5.5% in the closed sales in June 2023 compared to June 2022. Additionally, the Year-to-Date (YTD) comparison showed a decrease of 15.8%, suggesting a slowdown in home purchases in 2023.

- Median Sales Price: The median sales price fell by 8.0% in June 2023 compared to June 2022, with a more significant decrease of 11.1% YTD, suggesting a cooling off of the market or a shift in the type of homes being sold.

- Days on Market: Homes took longer to sell in 2023, with a 120.0% increase in June and a 166.7% increase in YTD, reinforcing the signs of a slowing market.

- Inventory: The available inventory decreased by 36.2% compared to June 2022, which would typically drive prices up due to limited supply. However, the combination of increased days on the market and decreased prices suggests that demand may have decreased faster than supply.

- Existing/Resale Homes:

- These trends are largely similar to the overall single-family home trends, with decreases in closed sales, median sales price, and inventory, and an increase in days on the market. However, the decreases are generally more pronounced, particularly in closed sales (-22.9% YTD) and inventory (-40.1% in June 2023), suggesting a particularly significant slowdown in the existing home market.

- New Construction Homes:

- For new construction homes, the trends diverge somewhat from the overall single-family home trends. Closed sales decreased by 7.9% in June 2023, but interestingly, they remained relatively steady YTD (+0.4%).

- Median sales prices showed a significant decrease (-19.2% in June, -13.9% YTD), suggesting a possible shift in the types of new homes being built or potentially reduced demand for new construction.

- Days on the market increased even more significantly than for existing homes (+226.3% in June, +187.1% YTD), which may reflect increased competition from existing homes, construction delays, or reduced urgency among buyers.

- The decrease in inventory was also significant, though less so than for existing homes (-29.2% in June 2023).

In general, these statistics suggest a slowdown in the Ada County real estate market in 2023, with fewer sales, lower prices, and homes taking longer to sell. The slowdown appears to be more pronounced in the existing home market than in new construction. The decrease in inventory across the board suggests that supply is also decreasing, but not as fast as demand. These trends could be due to a variety of factors, such as changes in the local economy, interest rates, buyer preferences, or broader housing market trends. It would be important to consult with a local real estate professional for more specific insights and advice.

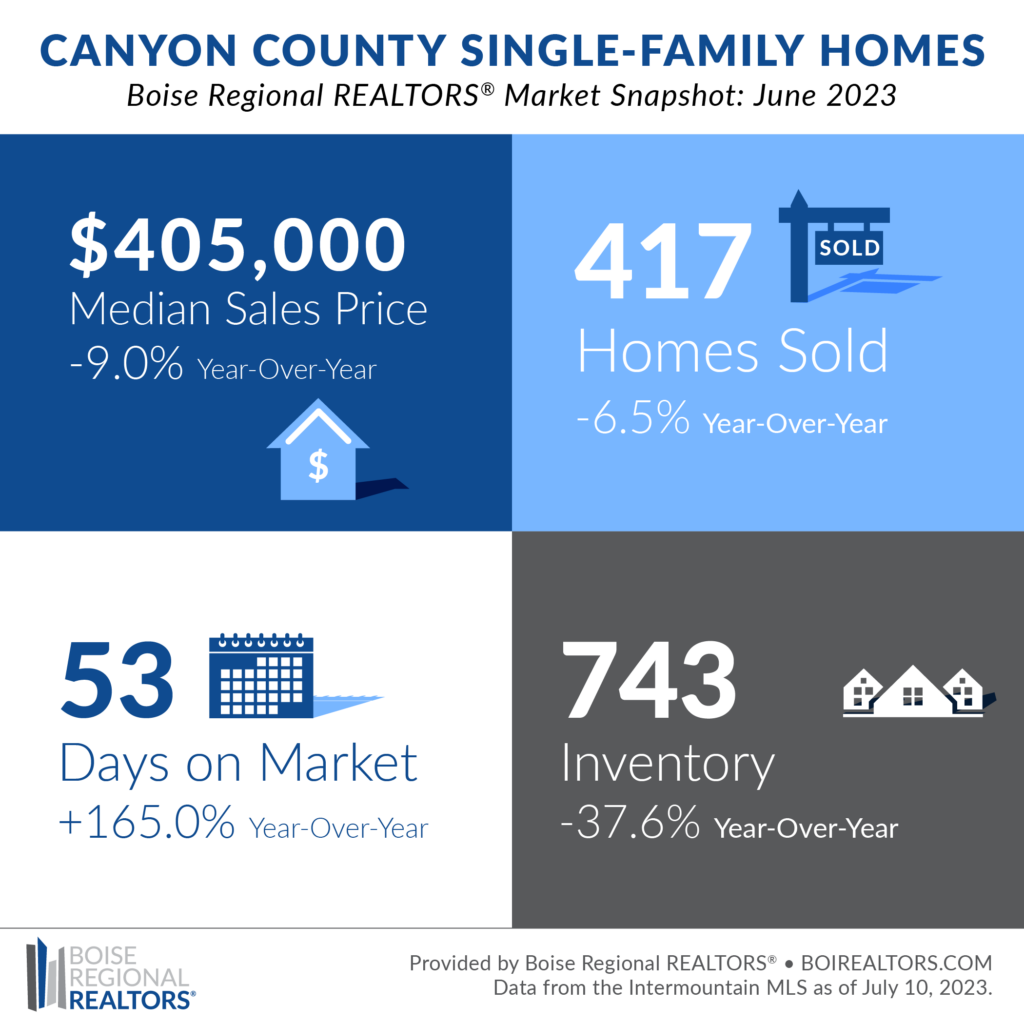

CAYNON COUNTY HOUSING MARKET JUNE 2023

- Overall market:

- Closed sales: 417 (a 6.5% decrease compared to June 2022)

- Median Sales Price: $405,000 (a 9.0% decrease compared to June 2022)

- Days on Market: 53 (an increase of 165% from June 2022)

- Pending Sales: 743 (a 17.8% decrease from June 2022)

- Inventory: 743 (a decrease of 37.6% from June 2022)

- Months Supply of Inventory: 1.8 (a 20.3% decrease from June 2022)

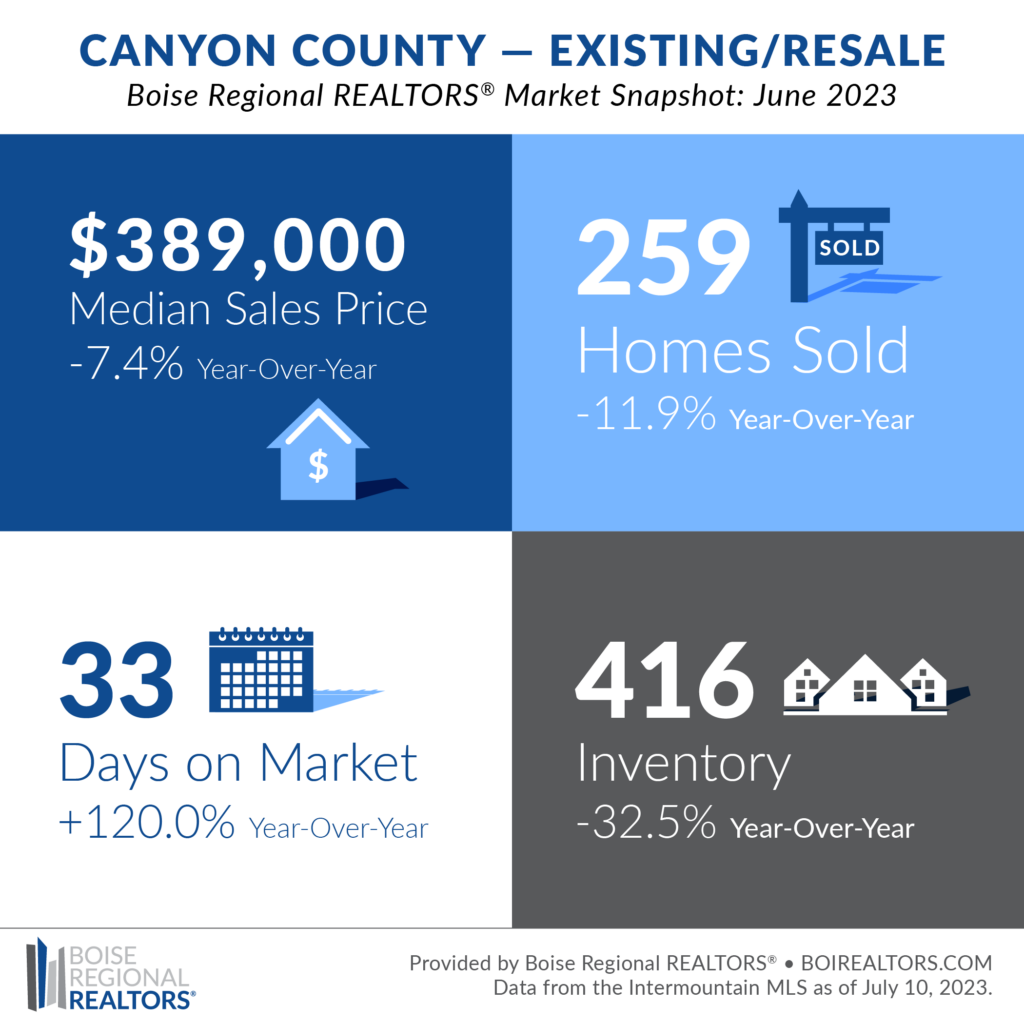

- Existing/Resale market:

- Closed Sales: 259 (an 11.9% decrease compared to June 2022)

- Median Sales Price: $389,900 (a 7.4% decrease compared to June 2022)

- Days on Market: 33 (a 120% increase compared to June 2022)

- Pending Sales: 216 (a decrease of 12.2% compared to June 2022)

- Inventory: 416 (a decrease of 32.5% from June 2022)

- Months Supply of Inventory: 1.9 (a slight increase of 0.6% from June 2022)

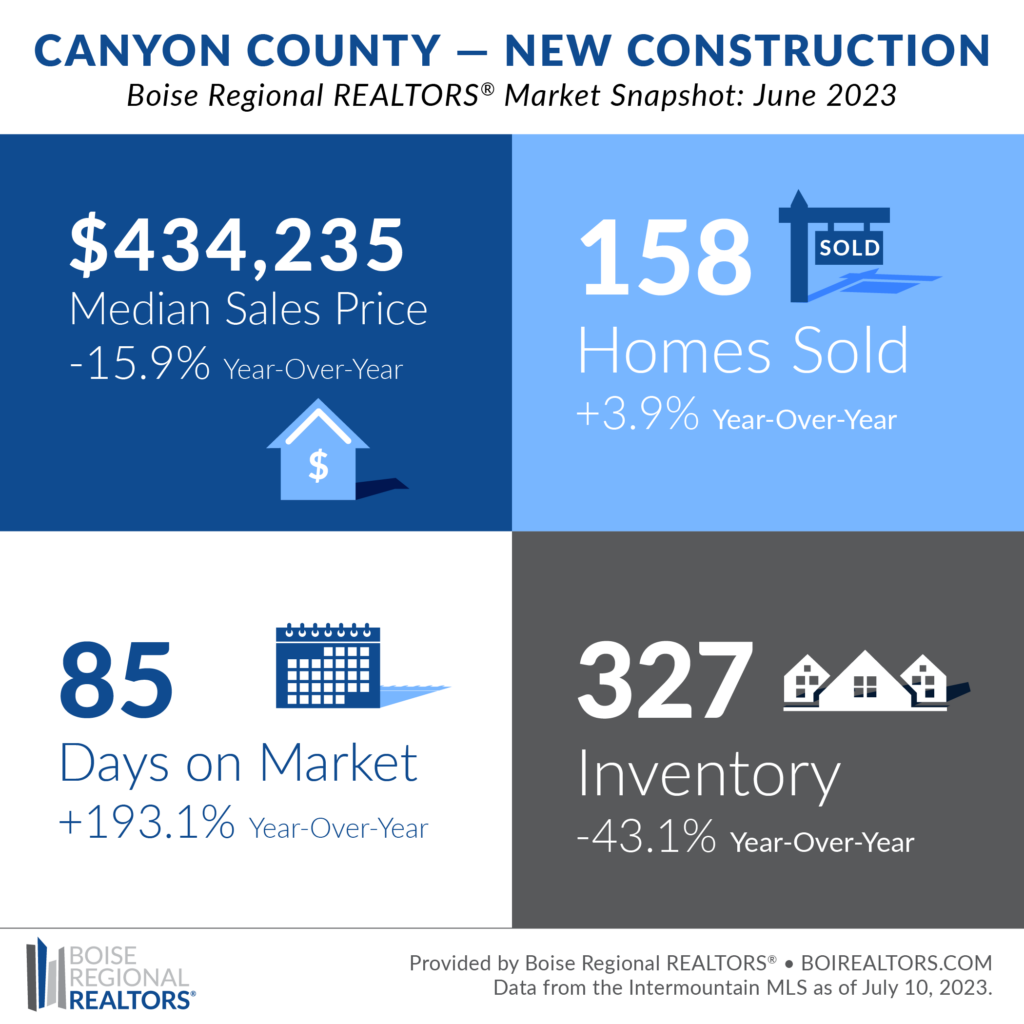

- New Construction market:

- Closed Sales: 158 (an increase of 3.9% compared to June 2022)

- Median Sales Price: $434,235 (a decrease of 15.9% compared to June 2022)

- Days on Market: 85 (an increase of 193.1% compared to June 2022)

- Pending Sales: 527 (a decrease of 19.9% compared to June 2022)

- Inventory: 327 (a decrease of 43.1% compared to June 2022)

- Months Supply of Inventory: 2.0 (a decrease of 35.7% from June 2022)

It’s evident that both in the general market and the resale market, the number of closed sales, pending sales, and inventory have decreased compared to June 2022. The days on the market have increased as well, suggesting a slowdown in the rate of sales.

On the other hand, in the new construction market, closed sales have increased slightly, but inventory, median sales price, and pending sales have decreased. The days on the market have drastically increased, possibly due to a slowdown in new constructions getting completed and sold.

Finally, the decrease in months’ supply of inventory in all segments indicates a continued seller’s market, where demand is higher than supply. This can often result in bidding wars and homes selling over the asking price. But it’s interesting to note that median sales prices have decreased across all segments, which may be a sign of the market starting to cool off or adjust.

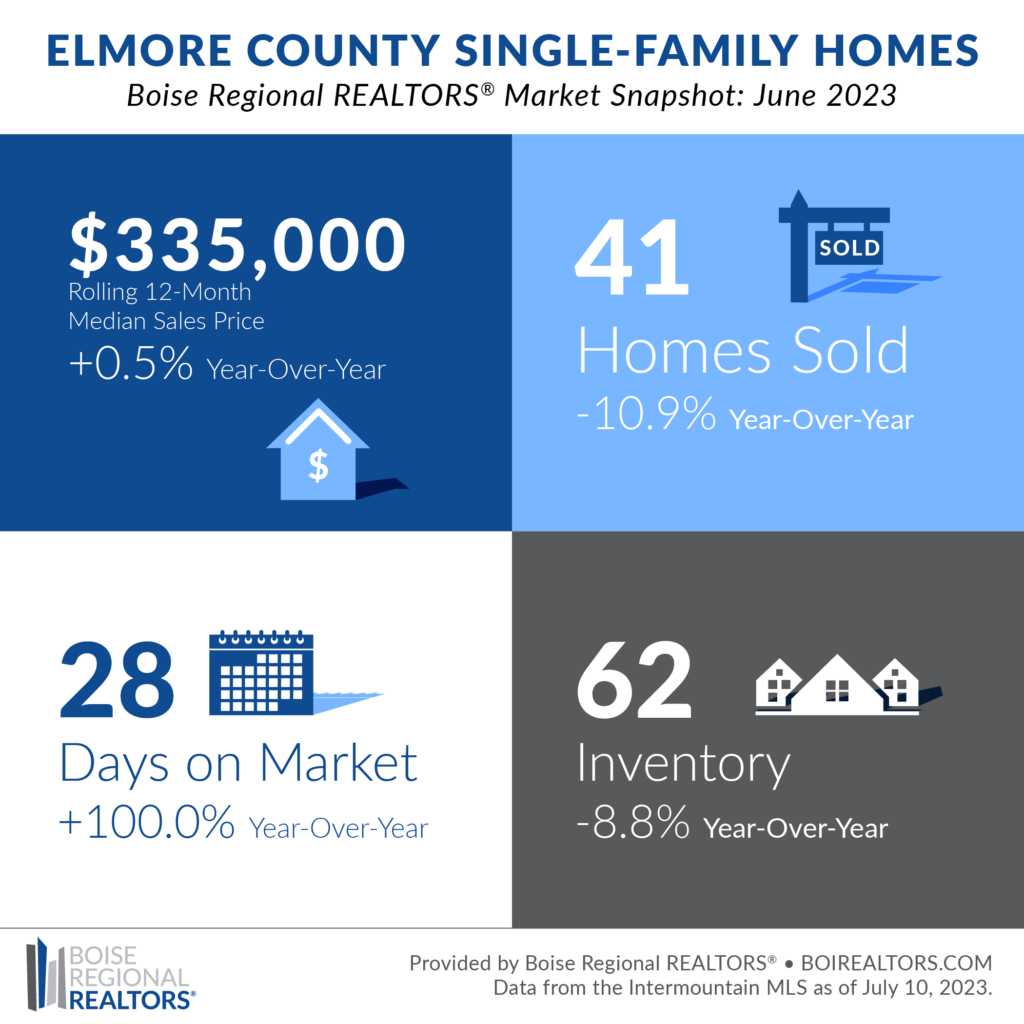

ELMORE COUNTY HOUSING MARKET JUNE 2023

The rolling 12-month median sales price for Elmore County home sales was $335,000 in June 2023, a 0.5% boost from June 2022 but a $5,000 slide from last month. Due to the smaller number of transactions that occur in the area, we use a rolling 12-month median sales price to get a better idea of the overall trends. June was the closest we’ve seen to a price decrease in 14 weeks.

Elmore County was the only county in BRR’s orbit to see year-over-year growth for pending contracts, up by 7.8% for a total of 55 pending sales for single-family homes. The breakdown between sectors showed a 7.1% drop in resale pending and a 77.8% lift in new construction activity.

New construction listings spent more than double the amount of time on the market than existing homes in June. Up 71.4% from last year, new builds went under contract an average of 60 days after hitting the market. Existing homes were swept away much quicker at only 26 days. An important piece to note is that builders are now (once again) placing To Be Built properties in the MLS, sometimes months ahead of the completion date.

This is reflected in the longer days on the market for new construction. The quick pace for existing homes may pose concern for inventory which saw its first year-over-year decline in 17 weeks — down to 48 available homes. The slim availability brought resale homes’ months’ supply of inventory down to 1.4 in June which is just .1 higher than last year. New construction remains the closest to a “balanced market” (a market with a supply of 4-6 months that doesn’t favor buyers or sellers), coming in at 3.8 MSI. Many sellers are hesitant to abandon their current interest rate to purchase a new home.

Buyers are patiently waiting for more options to become available while sellers are hesitant to abandon their attractive interest rates from purchases during the pandemic. It’s important to remember, however, that interest rates can be bought down with the cash equity from your current home if moving is in the cards for you.

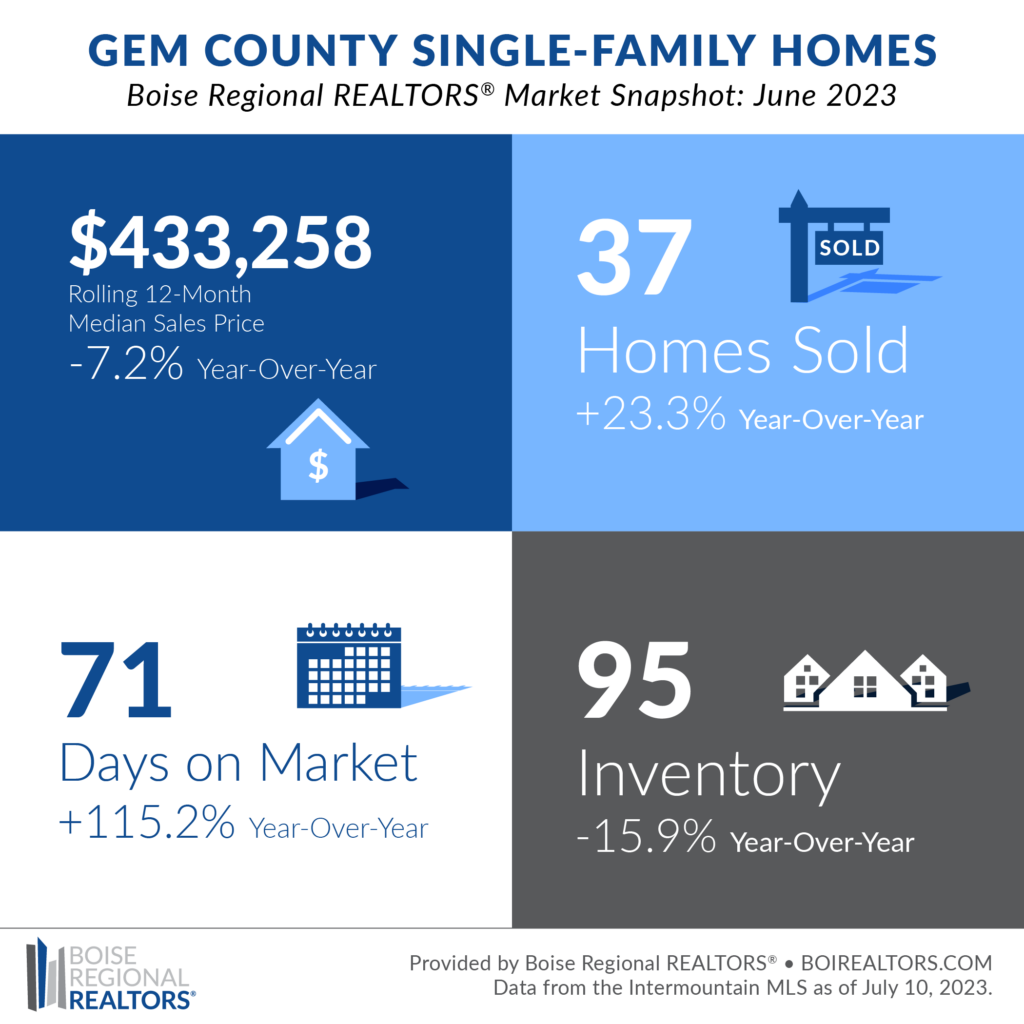

GEM COUNTY HOUSING MARKET JUNE 2023

The rolling 12-month median sales price for Gem County home sales was $433,258 in June 2023, a 7.2% decrease from the year before but a mirror image of last month. Due to the smaller number of transactions that occur in the area, we use a rolling 12-month median sales price to get a better idea of the overall trends. June followed a three-month trend in sales price cuts, contrasted with the consistent increases we’d seen between May 2016 and March 2023.

While median sales prices have taken a nap, average list prices have agitated. The $510,179 average listing price wakened by $20,000 compared to the month before but snoozed by about $29,000 year-over-year. We may see those listings come down a touch in price as pending contracts have shrunk in June 2023 by 32.7% from June 2022 for a total of 35 pending sales.

Homes in Gem County are taking longer to get into pending status, averaging 71 days on the market before going under contract. This is the second month of stretched market times, up 19 days from May 2023. Existing/resale homes are experiencing approximately half the waiting period of all single-family homes at 36 days while new construction came in at 145 days for the month. An important piece to note is that builders are now (once again) placing To Be Built properties in the MLS, sometimes months ahead of the completion date. This is reflected in the longer days on the market for new construction.

A potential factor for the change in the market could be the number of options available for purchasers to choose from. June presented 95 available single-family homes — 62 resale homes and 33 new construction homes — a 15.9% reduction from last June’s options and the first downward year-over-year trend we’ve seen since April 2021. The reason for the shortage could be that sellers are weary of stepping into more recent interest rates to purchase a new home. Buyers are patiently waiting for more options to become available while sellers are hesitant to abandon their attractive interest rates from purchases during the pandemic. It’s important to remember, however, that interest rates can be bought down with the cash equity from your current home if moving is in the cards for you. While supply remains drained, Gem’s sales in June were up by 23.3% compared to June 2022 (the first positive swing in four months), likely a reflection of the influx of pending sales we saw last month that would have closed this month.

Good News Realty Group LLC, located in Boise Idaho.

📲 Call Direct at 208-800-9073

📲 Email: info@goodnewsrealtygroup.com

We Offer a Comprehensive Real Estate Market Analysis and Examine the Current State of the Housing Market. If you’re looking to buy or sell real estate in Idaho, follow our updates.

Ready to buy? https://forms.gle/RHP6tFHUZMZydnLK6

Recent Comments